PCA Retirement Benefits Inc Housing Allowance free printable template

Show details

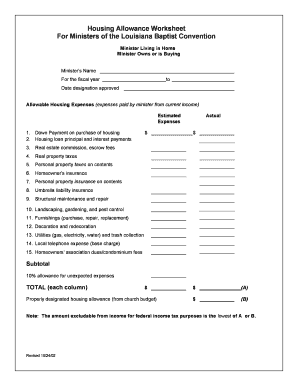

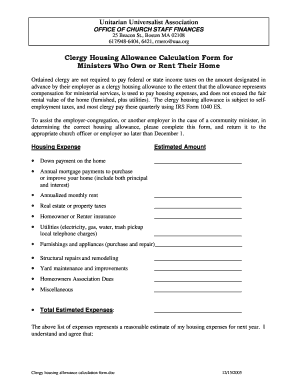

Housing Allowance Worksheet I The Housing Allowance Worksheet I is designed for ministers who expect to be living in a manse (section A) or those expect to be renting a home (section A&B). This worksheet

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign housing allowance worksheet form

Edit your pastor housing allowance worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pastoral housing allowance worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ministers housing allowance worksheet online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit housing allowance worksheet for pastors form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out clergy housing allowance worksheet form

How to fill out pastor housing allowance:

01

Gather all necessary information and documents, such as the pastor's annual salary, housing expenses, and any additional benefits received.

02

Consult with a tax professional or accountant to ensure compliance with tax laws and regulations regarding housing allowances for pastors.

03

Use Form 1099 to indicate the pastor's income, and Form 4361 if the pastor is exempt from Social Security and Medicare taxes.

04

Complete Form 1040 and include the pastor housing allowance on line 21 or Schedule SE if applicable.

05

Double-check all entries for accuracy and ensure all supporting documentation is included.

06

File the completed forms electronically or by mail before the appropriate deadline.

Who needs pastor housing allowance:

01

Pastors or religious leaders who receive housing as part of their compensation.

02

Individuals who are employed by a religious organization or perform ministerial duties.

03

Those whose housing expenses are identified and documented as a housing allowance by their religious organization.

Fill

housing allowance examples

: Try Risk Free

People Also Ask about housing allowance worksheet pdf

Can a pastor get a housing allowance?

A minister's housing allowance (sometimes called a parsonage allowance or a rental allowance) is excludable from gross income for income tax purposes but not for self-employment tax purposes.

How is pastoral housing allowance calculated?

To determine your housing allowance, you should calculate both your anticipated expenses and the fair market rental value of your home. Then request the lesser amount.

What is the housing allowance for pastors in 2023?

Housing Allowance - The minimum Housing Allowance for 2023 has been increased to $26,400.

What is the average housing allowance for a pastor?

The median base salary for part-time solo pastors is $14,400, while the median housing allowance is $12,000.

How much can a pastor claim as housing allowance?

A minister can designate up to 100% of their salary be paid to them as a housing allowance. However, the IRS states that the maximum amount it will allow to be excluded from gross income is the smallest of the following: 1. The amount actually paid to provide for the personal residence for the year, 2.

How does a housing allowance work for a pastor?

A housing allowance offers ministers the ability to deduct a portion of their gross income that they spend on housing costs from their federal income taxes. Housing allowances can include all big-ticket housing expenses, such as mortgage payments, rent, utilities, home insurance, home improvements, and so much more.

What is a reasonable housing allowance for pastors?

The median housing allowance for full-time solo pastors breaks down as follows by church income: $250,000 or less per year: $18,000. $251,000 to $500,000 per year: $25,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute ministerial housing allowance worksheet online?

Easy online housing allowance form completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How can I fill out minister's housing allowance worksheet on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your pdffiller. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Can I edit pastor compensation worksheet on an Android device?

You can make any changes to PDF files, like housing allowance for pastors, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is PCA Retirement Benefits Inc Housing Allowance?

PCA Retirement Benefits Inc Housing Allowance is a financial benefit provided to eligible members to assist with housing costs, typically as part of a retirement package.

Who is required to file PCA Retirement Benefits Inc Housing Allowance?

Individuals who are receiving housing allowances under the PCA Retirement Benefits Inc program or those managing these benefits for retirees are generally required to file.

How to fill out PCA Retirement Benefits Inc Housing Allowance?

To fill out PCA Retirement Benefits Inc Housing Allowance, individuals should obtain the required forms, accurately report their housing expenses, and provide any necessary documentation to support their claims.

What is the purpose of PCA Retirement Benefits Inc Housing Allowance?

The purpose of PCA Retirement Benefits Inc Housing Allowance is to provide financial support for housing costs to ensure that retirees have a stable living situation as part of their retirement benefits.

What information must be reported on PCA Retirement Benefits Inc Housing Allowance?

Information that must be reported includes the individual's name, address, the amount of the housing allowance, and any relevant supporting documentation such as lease agreements or mortgage statements.

Fill out your PCA Retirement Benefits Inc Housing Allowance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Housing Allowance Form For Pastors is not the form you're looking for?Search for another form here.

Keywords relevant to irs housing allowance

Related to pastor housing allowance form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.